[ad_1]

♥️

Megan Hale is a business strategist and money mentor for equity-driven entrepreneurs ready to create sustainable, aligned business growth.

She began her current business after starting her first one, a brick and mortar psychotherapy practice. Being in business for herself was a dream but, as an active-duty military spouse, she knew that she would eventually have to close her practice. She wanted something more flexible so she wouldn’t have to start her business anew every few years when her family had to relocate.

That’s when she discovered the realm of online coaching and decided to pivot her education and training in a fresh direction. Over the years, her focus shifted from life coaching to business coaching. Now, her team supports coaches, consultants, therapists, and healers in developing their signature methodology, creating or expanding their intellectual property, building and streamlining their offer suite, and deepening their business mastery needed to sustainably scale.

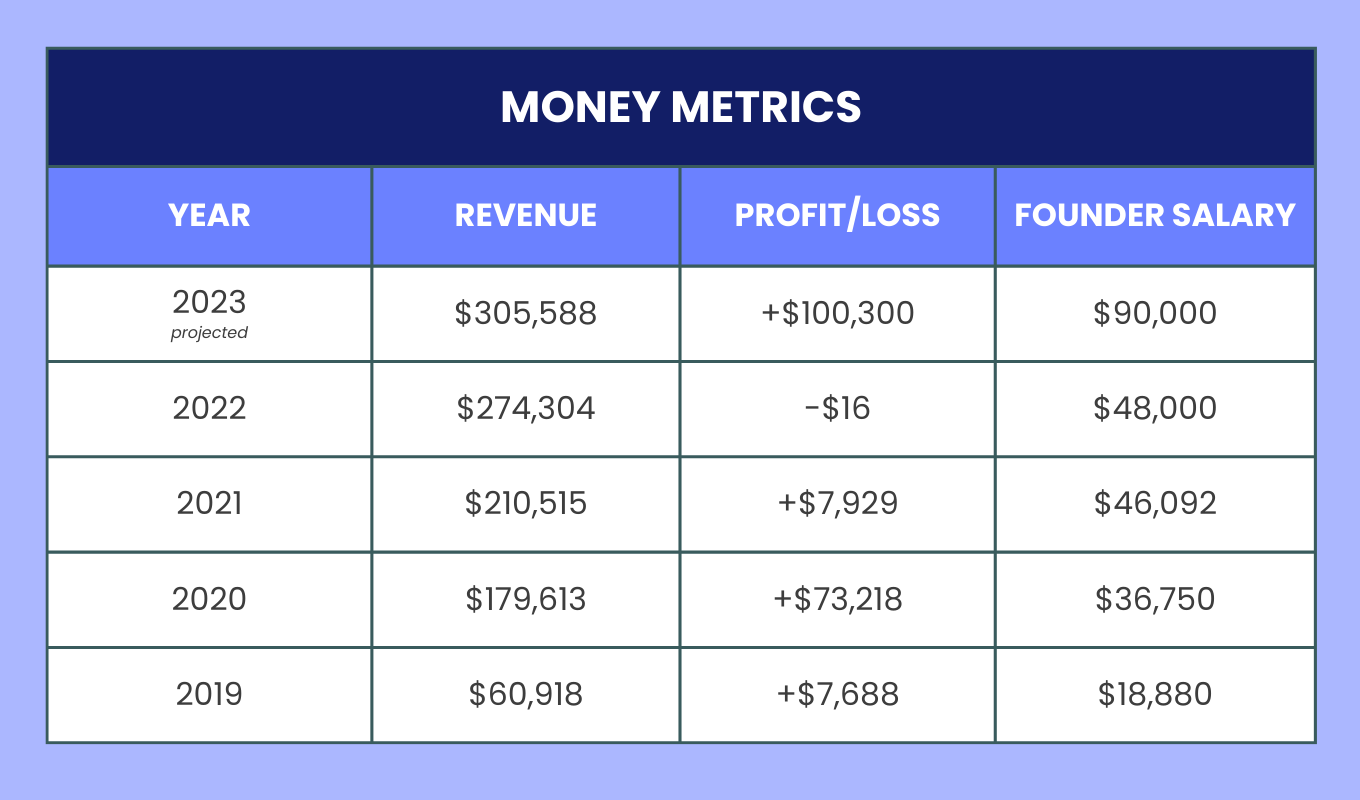

Read on to learn how she’s grown a six-figure online business that can support the needs of her life.

Business Snapshot

Years in business: 8

Number of employees: 1 part-time

Location: Omaha, NE, with a team member in Calgary

Initial capital invested: $50,000

Financial support for business: EIDL loan and PPP loan during the pandemic

Revenue streams:

Growth Journey

What’s been your proudest financial achievement as a business owner?

I was so proud of my first multiple six-figure offering in 2021, especially since it was a few years in the making.

My first iteration of the program launched in November 2019 and brought in five clients while generating $35,000—but then had trouble selling for months afterward, even though my first few clients got amazing results. I launched it three more times in 2020 (once launching to crickets with zero sales, once generating just one sale, and the final time generating four sales) before determining the name of the program wasn’t resonating with my audience. From there, I went back to the drawing board and continued serving clients one-on-one with all the methodology and frameworks I had developed.

In July 2021, I tried again with a new format and a new name and brought in 36 clients while generating $233,000 in its first launch and an additional $97,000 with 18 more clients a few months later. This program continues to be a foundational part of my offer suite to this day, and I’m so glad I didn’t give up after a few flopped launches along the way.

What have you found is worth paying for to help you grow? On the flip side, where have you been able to get by more scrappily?

Done-for-you work has always been the most valuable investment for me. When you find talented people who will move a project to completion, it’s worth its weight in gold!

I know how to do almost everything behind-the-scenes in my business, which has definitely been an asset because I can be quite scrappy when need be. But having assets like copy, content, workflows, organization, and more created for me has been such a time-saver, not to mention revenue generating because I can focus on other things.

How do you decide how much to pay yourself versus invest back in the business?

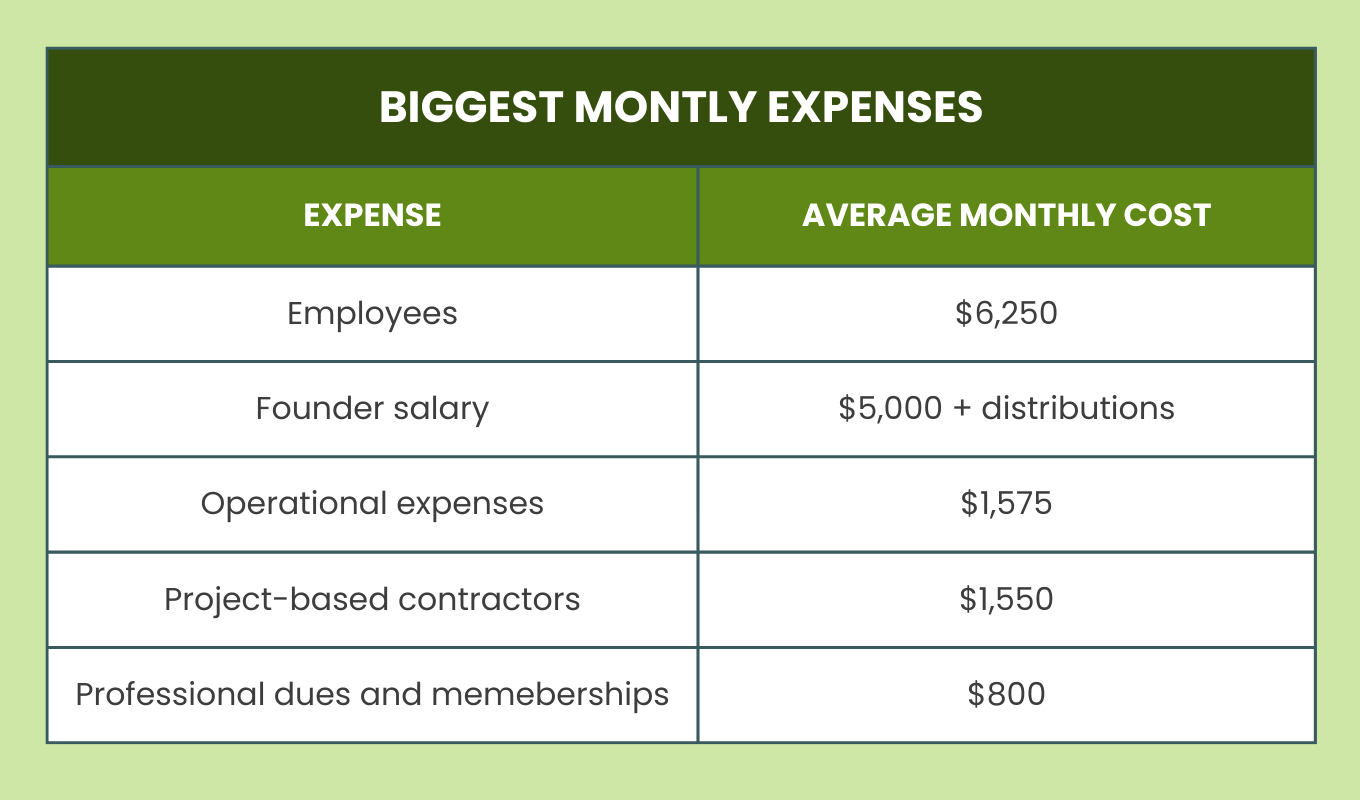

I base that decision on my own financial needs and dreams, which I clarify and calculate every year. My personal lifestyle budget is based on needing to contribute $48,000 per year to a dual income household. Anything above that goes to funding life dreams. But because dreams are “nice to have” and not a necessity, I’ve found I’ve had to motivate myself to reach them in other ways like making them non-negotiable. Otherwise, it’s so easy to reinvest additional profits back into the business.

For reinvesting, I create a revenue plan every year and cast yearly revenue projections. On average, I plan on reinvesting 10 to 15 percent of projected revenue back into the business. With that reinvestment budget in mind, I detail out the projects I’m committed to that the business needs to grow and make a list of the support I need to make them happen.

This not only helps me minimize “shiny object syndrome” and practice discernment with my money, but also helps me stay on track with how much I reinvest back into the business.

Tell us about your team. At what point did you decide to hire employees or contractors? How do you think about when and who to bring on now?

My current team is very intimate. I have one part-time employee who has been with me for almost three years and several contractors who are in project-based roles.

I’m really focused on keeping operations lean and have found contractors who bring a very specific expertise to be a great fit in this season. I currently have three additional contractors in various roles: an ads manager, a social media content creator, and a graphic designer on an as needed basis.

Every four months, I sit down and look at projects to determine what additional support I may need to bring on. I always try to hire contractors a month ahead of time so they acclimate to my business and stay on track with our project timelines.

What specific strategies or marketing techniques did you employ to attract your first customers or clients?

I got my start by cold pitching large publications and writing guest posts for them, then including a link to a free Facebook group in my bio.

From there, I would leverage that group to build connection and rapport by sharing inspirational or educational content several times a day. By building a community with a shared sense of belonging—that we were all on a path of growth and expansion—I landed my first few clients.

I also started a podcast eight months into starting my business and interviewed 75 influential people in my first season. It was great for getting myself in front of other peoples’ audiences.

What are some of your most impactful growth strategies now?

Collaborations and relationship building. My most powerful strategies are delivering guest trainings in other peoples’ programs, appearing on other peoples’ podcasts, or writing for larger publications.

I also always fill my calendar with coffee chats to form connections. You never know when you’ll find your next referral or collaboration. Plus, I always ask how I can support someone else’s goals when we meet, which can lead to a new client or just solidify the relationship.

What’s a turning point that really impacted how you thought about your business or approached growth?

When I stopped looking for the “easy button.” I had this false belief that at some point business would get easier or more certain. Some things certainly do, but every new level comes with its own set of challenges. When I committed to the journey and the grit required, a lot more ease started to flow in.

What have been the greatest growth or money challenges you’ve experienced? How have you worked through them?

Living through a pandemic, for one: The first few months were very uncertain, so instead of focusing on my higher-ticket offers, I pivoted to focusing on my more affordable offers and ended up tripling revenue from the prior year.

The absolute hardest money crisis, though, came after 2018 when I became a mom to two under two while my husband was deployed for six months. I did everything I could to make sure I was taking care of myself and I still became depleted. That following year, my capacity took a nose dive as I navigated mental health issues directly related to everything I was trying to manage.

This was also early on in my business when I had not created many standalone assets to support my clients, which meant everything had to come from me and my ability to show up, deliver, and market. That year, I learned the importance of creating offerings that can live outside yourself and systems that make it easy for other people to help keep your business going. These lessons have directly informed the assets and systems I’ve now created in my own business, and also the assets and systems I now help my clients create so their businesses have a much more sustainable foundation.

We are always humans first, who happen to be running a business, which means our capacity is going to shift depending on what else is on our shoulders. I never plan my business such that I have to show up at 100 percent at all times, because no human is capable of doing that. I’ve learned to give myself grace when I need to adjust timelines, when I need to take breaks, when business needs to slow down for a bit to better support other things I have going on in my life.

Taking a human-first approach to business growth and strategy is a hill I’ll die on. In the age of the internet—when everything can be batched and scheduled and your business can seemingly operate as usual even when life is far from usual—I think it does a great disservice to ourselves as business owners to put pressure on ourselves to be always on.

What are your next growth goals? What do you plan on investing in to help you achieve them?

I’m in the process of starting my second company, so my growth goals are mostly focused on developing my profit planning tool into a SaaS product and gaining our first 1,000 users.

I’ll be investing in SaaS development with both a UX developer and UX designer and likely a few strategy intensives with a fractional CPO (chief product office) as I move into a completely new business model. Beyond money, I’ll definitely be investing time and energy into relationships, visibility, and partnerships to ensure the best possible user experience and success of the product.

Based on your experience, what advice would you give someone who had a business like yours for growing successfully?

The most valuable piece of money advice I wish I’d received is how much it really takes to get your business off the ground. If someone would have told me to expect to invest at least $100,000 to get things to a sustainable place, I would have had much more realistic expectations and much less shame in the early years when I was investing so much in this vision without getting a lot back in return.

What I know now is that there is so much education that goes into building a successful business. Just like we normalize investing tens of thousands in undergrad and grad school education, it’s not uncommon to need to also invest in your business education to learn the skills we need to create the kind of growth we desire.

[ad_2]

Source link